Malaysia is embracing digital tax compliance with the e-invoice specific guideline under LHDN’s MyInvois system. This shift enhances efficiency, transparency, and automation in business transactions.

By replacing manual invoicing, businesses can reduce errors, improve tax reporting accuracy, and streamline operations. With phased implementation from 2024 to 2026, companies must understand the LHDN e-invoice guideline to stay compliant and avoid penalties.

This guide will walk you through what e-invoicing (electronic invoicing) is, its benefits, compliance to e-invoicing Malaysia guidelines, and implementation steps to assist your business in making the transition smooth and hassle-free.

Key Takeaways

- An e-invoice is a digitally issued and validated invoice that ensures tax compliance and automation under Malaysia’s LHDN MyInvois system.

- All businesses, individuals, and legal entities engaged in commercial activities in Malaysia must comply with LHDN’s e-invoicing regulations.

- Malaysia’s phased e-invoicing rollout runs from 1 August 2024 to 1 January 2026, with full compliance required for all businesses by the final deadline.

- Businesses must issue e-invoices at the point of sale, service completion, or payment receipt, depending on transaction type and tax requirements.

- Malaysia recognises various e-invoice types, including standard, simplified, credit note, debit note, self-billed, and export invoices, each serving different business needs.

- E-invoicing enhances accuracy, tax compliance, efficiency, cost savings, and real-time tracking, reducing manual errors and processing delays.

- Businesses can submit e-invoices via direct API integration, third-party e-invoicing providers, or manual entry through LHDN’s MyInvois Web Portal.

- The guidelines cover who must comply, invoice format, validation process, storage requirements, submission methods, and penalties for non-compliance.

- Failure to comply may result in fines, tax audits, legal action, business disruptions, and loss of government incentives, with penalties up to RM20,000 or six months of imprisonment under the Income Tax Act 1967.

What is E-Invoice in Malaysia?

An e-invoice in Malaysia is a digitally structured invoice that follows the Inland Revenue Board of Malaysia (IRBM or LHDN) MyInvois system for tax compliance and automated reporting. Unlike traditional paper or PDF invoices, an e-invoice is generated, transmitted, and validated electronically, ensuring real-time tracking and accuracy in financial transactions.

Which Country Using E Invoice?

E-invoicing is widely adopted across various countries as governments seek to enhance tax compliance, transparency, and digital transformation.

Many nations have mandatory e-invoicing regulations, while others are in the implementation phase. Here are some key countries using electronic invoicing:

| Country | E-Invoicing Implementation |

| European Union (EU) | Mandatory for public procurement under EU Directive 2014/55/EU. Expanding to B2B & B2C in some countries. |

| Italy | Mandatory for all businesses since 2019, using a centralised validation framework. |

| India | Required for businesses with revenue above ₹5 crore (RM2.7M), integrated with the GST system. |

| Singapore | Not mandatory, but businesses are encouraged to adopt the Peppol e-invoicing network. |

| Brazil | Established e-invoicing system (NF-e) for B2B, B2G, and consumer transactions. |

| Saudi Arabia | Mandatory under Zakat, Tax and Customs Authority (ZATCA), implemented in two phases. |

| Malaysia | Phased rollout from 2024 to 2026 via LHDN’s MyInvois system, starting with large taxpayers. |

Who Needs to Comply with E-Invoice Requirements in Malaysia?

As outlined in LHDN’s e-Invoice Guideline Version 2.3 (Section 1.3), all individuals and legal entities conducting business activities in Malaysia are required to comply with e-invoicing regulations. Entities and taxpayers subject to mandatory e-invoicing compliance include:

- Corporations

- Partnerships

- Limited Liability Partnerships (LLP)

- Branches

- Business Trusts

- Co-operative Societies

- Real Estate Investment Trusts (REITs)

- Property Trusts and Property Trust Funds

- Unit Trusts

- Trust Bodies

- Associations

- Bodies of Persons

- Representative Offices and Regional Offices

E Invoice Malaysia Implementation Date: Key Phases & What to Expect

Malaysia is rolling out e-invoicing in phases from 2024 to 2026, ensuring businesses have ample time to transition to the LHDN MyInvois system.

The timeline of e invoice implementation date is structured based on annual revenue thresholds, with larger businesses required to comply first.

| Phase | E Invoice Start Date | Who Must Comply? |

| Phase 1 – Large Taxpayers | 1 August 2024 | Businesses with annual revenue > RM100 million |

| Phase 2 – Medium-Sized Businesses | 1 January 2025 | Businesses with annual revenue > RM125 million |

| Phase 3 – SMEs & Growing Businesses | 1 July 2025 | Businesses with annual revenue > RM500,000 |

| Phase 4 – Full Implementation | 1 January 2026 | All businesses with revenue > RM150,000, including micro-enterprises |

By 1 January 2026, all businesses in Malaysia—regardless of size—must adopt e-invoicing, ensuring greater transparency, efficiency, and compliance with LHDN regulations. Businesses should start preparing early to integrate the right e-invoicing solutions and avoid last-minute disruptions.

When to Issue E-Invoice?

Under LHDN’s e-Invoice guideline, businesses must issue e-invoices at the time of a taxable supply of goods or services. The timing depends on the nature of the transaction and when ownership or services are transferred.

| Type of Transaction | When to Issues an E-Invoice |

| Goods Supplier | At the point of transfer of ownership or delivery. If payment is received before delivery, an e-invoice must be issued at the time of payment. |

| Services Supplier | At the time the service is performed or when payment is received. If no upfront payment, issue upon service completion. |

| Advance Payments or Deposits | Upon receipt of payment. If a deposit is made, an e-invoice must be issued immediately. A separate e-invoice is required for the balance upon completion. |

| Credit Notes & Debit Notes | When adjustments are made to a previously issued e-invoice. Credit notes for refunds or discounts, debit notes for additional charges. |

| Cross-Border Transactions | At the time of export or import documentation submission. An e-invoice must be issued when goods are cleared for shipment or received by the importer. |

4 Types of E-invoices in Malaysia

As Malaysia transitions to e-invoicing under LHDN’s MyInvois system, businesses must submit specific types of e-invoices to ensure tax compliance and accurate financial reporting. While various e-invoice formats exist, the most commonly used in Malaysia include:

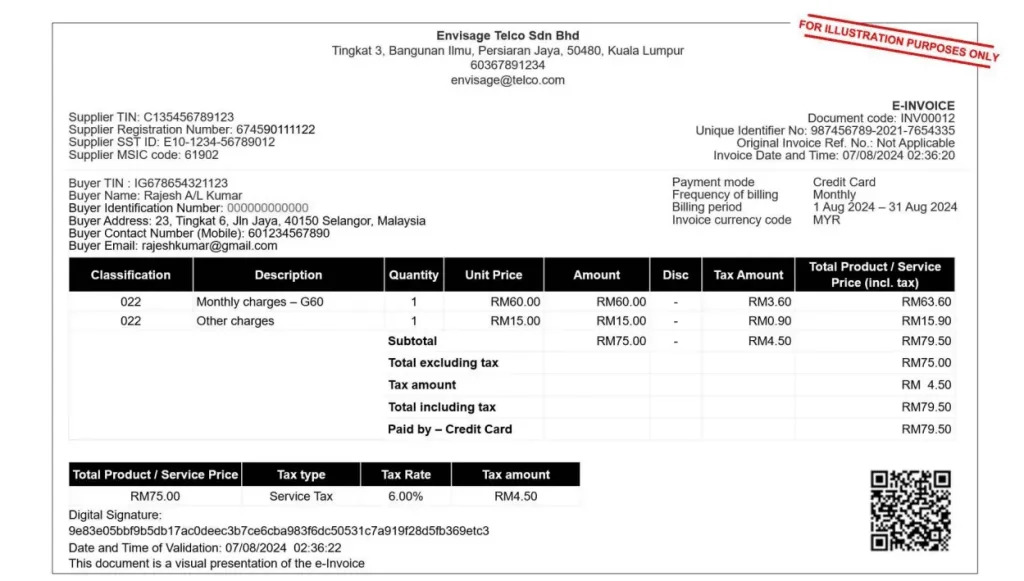

1. Standard E-Invoice

This is the most widely used e-invoice for transactions involving the sale of goods or services between supplier and buyer.

Standard E Invoice Sample

It contains the seller and buyer details, invoice number, transaction date, tax breakdown, and total amount, ensuring proper documentation of a self-billed e-invoice issuance for expense recording.

2. Consolidated E-Invoice

What is a consolidated e-invoice? It is a single electronic invoice that combines multiple transactions between the same buyer and supplier within a specified period.

Consolidated E Invoice Sample

Businesses generate one summary invoice instead of issuing separate invoices for each transaction, reducing administrative work and simplifying tax reporting.

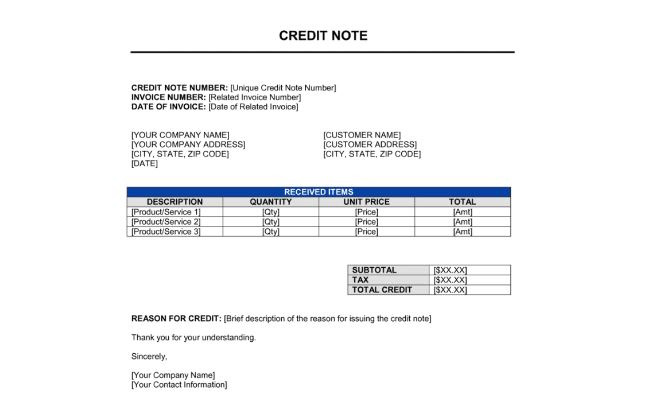

3. Credit Note E-Invoice

A credit note e-invoice is issued when businesses need to reduce the amount due on a previously issued invoice.

Credit Note E Invoice Sample

This occurs in refunds, discounts, product returns, or invoice corrections. It is crucial for adjusting tax calculations and maintaining accurate records in MyInvois.

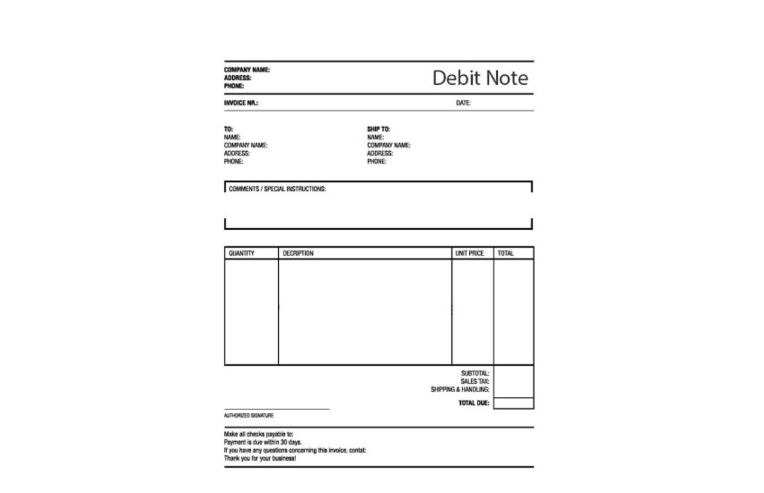

4. Debit Note E-Invoice

A debit note e-invoice is required when a seller needs to increase the amount payable due to pricing adjustments, additional charges, or underbilling in the original invoice.

Debit Note E-Invoice Sample

It acts as an amendment to a prior invoice and must be recorded in MyInvois.

Discover a collection of tools, libraries, resources at LHDN’s e-invoice software development kit (SDK) to help you assist in integrating your existing system to the MyInvois System via API.

4 Key Benefits of E-Invoicing

The adoption of IRB e-invoicing in Malaysia offers numerous advantages for businesses, ranging from improved compliance to cost savings. By transitioning to a digital invoicing system, companies can enhance efficiency, reduce errors, and streamline tax reporting.

| Benefit | Details |

| Compliance & Transparency | Ensures accurate tax reporting by validating invoices through LHDN’s MyInvois system. Reduces risks of tax fraud, invoice manipulation, and human errors, ensuring businesses meet Malaysia’s e-invoice specific guideline. |

| Improved Business Efficiency | Automates invoicing to reduce workload of tax administration, speed up approvals, and minimise delays. Allows real-time transaction tracking, eliminating manual data entry and paperwork. |

| Cost Reduction | Eliminates expenses related to paper invoices, printing, postage, and storage. Reduces costs from invoice disputes and late payments, improving cash flow management. |

| Seamless Integration with Accounting Systems | Works with ERP and accounting software to automate tax calculations, generate financial reports, and streamline record-keeping. Reduces errors and ensures compliance with e invoice LHDN regulations. |

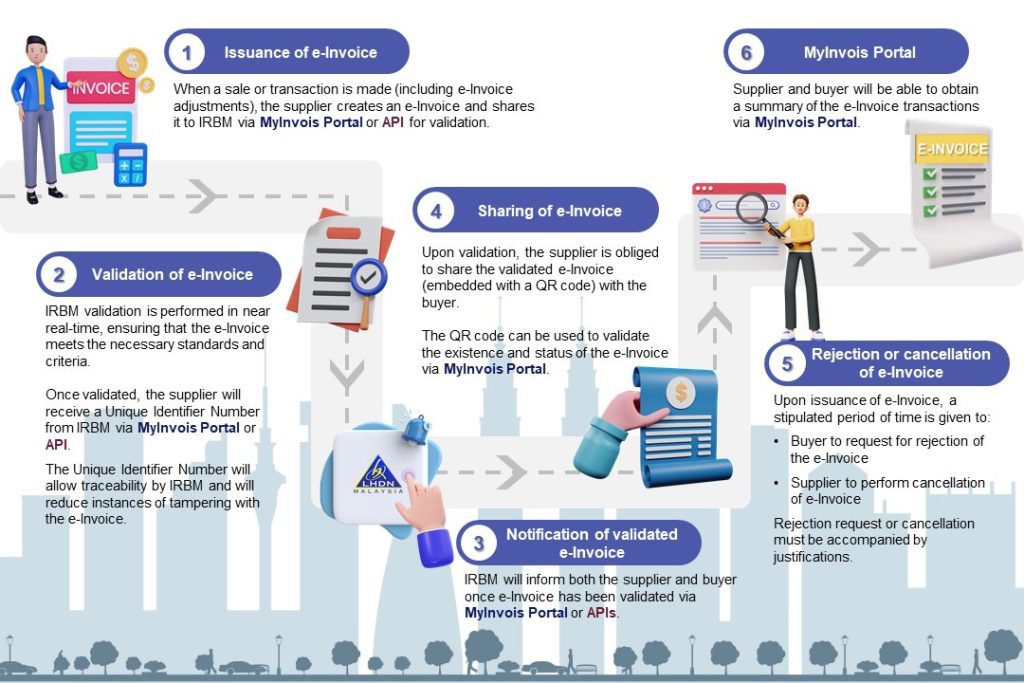

How E Invoice Works?

Businesses in Malaysia must submit e-invoices through LHDN’s MyInvois system, ensuring compliance with the country’s e-invoice clearance model. Depending on business size, transaction volume, and system capabilities, companies can choose from different submission methods.

| Submission Option | Best For | Key Benefits |

| Direct Integration with MyInvois (API-Based Submission) | – Large corporations and enterprises – Businesses with high invoice volumes – Companies using ERP or cloud-based accounting systems | – Automated real-time invoice validation – Eliminates manual errors and speeds up tax reporting – Seamless integration with business accounting systems |

| Third-Party E-Invoicing Service Providers (API Integration) | – Medium-sized enterprises – Businesses using external accounting services – Companies transitioning from manual invoicing to automation | – No need for in-house API integration – Secure and compliant submission to MyInvois – Scalable for growing businesses |

| Manual Submission via MyInvois Web Portal | – SMEs, micro-enterprises, and freelancers – Businesses with low invoicing frequency – Companies without ERP or cloud-based accounting systems | – No software or system integration required – Easy access via LHDN’s online portal – Suitable for businesses issuing invoices occasionally |

The image below shows the LHDN e-invoice workflow, starting from the initiation of a sale or transaction and proceeding to e-invoice issuance through either the MyInvois Portal or API. Once validated, the e-Invoices are securely stored in IRBM’s database, allowing taxpayers to access historical records when needed.

Ensure compliance and maximise savings with expert corporate tax planning in Klang and Selangor. Let NKH Chartered Accountants optimise your tax strategy today!

3 Key Areas in E-Invoice Guideline

Malaysia’s electronic invoicing guidelines, issued by LHDN (Inland Revenue Board of Malaysia), outline the mandatory requirements, compliance framework, and technical processes for businesses transitioning to MyInvois. Below are the thee key areas covered in the e-invoice guideline:

1. B2C Small Transactions

For small-value transactions involving consumers (B2C), businesses can issue a simplified e-invoice that may exclude buyer details if not required by tax regulations.

This is commonly used in retail, food & beverage, and e-commerce sectors where issuing a full invoice for every transaction may not be practical. However, businesses must still ensure that sales data is accurately reported to LHDN through MyInvois.

2. High-Value Transactions

For large B2B and high-value transactions, businesses must issue a detailed e-invoice containing:

- Full buyer and seller details (including Tax Identification Number – TIN)

- Invoice number and date

- Detailed breakdown of goods/services provided

- Tax amount and total payable

High-value transactions require real-time submission to MyInvois, ensuring tax accuracy and compliance. These invoices must be validated by LHDN before they are legally issued to the buyer.

3. Internal Expense Deductions

Businesses must also issue self-billed e-invoices when recording internal expenses or cross-entity transactions within the same company group. These invoices are used for expense tracking, tax deductions, and financial reconciliation.

For internal transactions, an e-invoice must include:

- Expense category and purpose

- Transaction date and reference details

- Tax calculations (if applicable)

- Entity details for compliance with MyInvois reporting

Looking for reliable financial and tax solutions in Malaysia? Discover how NKH Chartered Accountants can help your business grow.

What Are the Consequences of Not Complying with E-Invoicing in Malaysia?

Failure to comply with Malaysia’s e-invoicing regulations under LHDN’s MyInvois system can lead to financial penalties, tax audits, legal action, and business disruptions.

Under Section 120(1)(d) of the Income Tax Act 1967, failing to issue an e-invoice is an offence punishable by a fine of RM200 to RM20,000, imprisonment of up to six months, or both for each violation.

Non-compliant businesses risk delayed payments, rejected invoices, and cash flow issues, while frequent tax audits and reassessments may result in additional liabilities. Legal risks include tax evasion suspicions, inaccurate financial reporting, and exclusion from government tax incentives.

To avoid these consequences, businesses must ensure timely e-invoice validation and full compliance with LHDN’s phased implementation.

Simplify Your E-Invoicing Process with NKH Chartered Accountants

NKH Chartered Accountants offers comprehensive accounting services in Klang and Selangor to businesses by providing expert guidance, support, and training to ensure your business stays compliant. Our team offers comprehensive assistance in documentation, regulatory updates, and best practices, helping businesses transition smoothly to LHDN’s MyInvois system.

We specialise in integrating e-invoicing solutions with your existing accounting systems, ensuring real-time tracking, tax compliance, and improved financial management. With continuous insights and updates on e-invoicing regulations, we help businesses stay ahead of Malaysia’s evolving tax landscape while streamlining operations.

Unlock the true value of your business with e-invoicing insights and financial accuracy. Learn how to value a business and enhance your business worth with our business valuation services.

E-Invoicing Support for a Mattress Manufacturer

A leading mattress manufacturer in Seremban faced challenges in transitioning to Malaysia’s new e-invoicing framework while ensuring compliance with the Sales and Services Tax (SST) regulations. The company sought a structured approach to integrating e-invoicing with its existing accounting system while maintaining cost efficiency and tax optimisation.

Challenges

The business required a tailored e-invoicing solution that would:

- Ensure full compliance with SST regulations under Malaysia’s tax framework.

- Minimise tax liabilities while benefiting from available exemptions and credits.

- Streamline invoicing and reporting processes to improve accuracy and efficiency.

Solution Provided by NKH Chartered Accountants

NKH Chartered Accountants worked closely with the company’s management team to analyse operations and implement an e-invoicing strategy tailored to their needs. The key areas of support included:

- E-Invoice Integration – Assisting in seamless implementation of MyInvois with the company’s existing accounting system.

- Tax Optimisation – Identifying tax exemptions and credits available under the SST framework.

- Process Restructuring – Adjusting internal invoicing workflows to enhance accuracy and reduce administrative burdens.

- Regulatory Compliance Training – Providing guidance and ongoing support to ensure the finance team adhered to updated SST and e-invoicing regulations.

Outcome & Impact

Through NKH’s expert guidance and structured tax planning, the company successfully:

- Reduced tax liabilities, leading to significant cost savings.

- Ensured full compliance with e-invoicing and SST regulations.

- Streamlined invoicing and tax reporting, enhancing financial transparency.

- Optimised their cash flow management, allowing for reinvestment in business growth.

By implementing a robust e-invoicing and tax compliance strategy, the company achieved substantial financial savings and improved operational efficiency and reporting accuracy.

Note: Due to privacy concerns, we are not allowed to reveal the full company’s name.

Conclusion

The transition to e-invoicing in Malaysia is a significant step towards greater efficiency, transparency, and compliance in business transactions. With the phased implementation running from 2024 to 2026, businesses must begin preparing now to ensure a smooth transition before full adoption becomes mandatory.

By embracing e-invoicing, businesses can streamline financial processes, reduce errors, improve tax compliance, and enhance operational efficiency. Adopting LHDN’s MyInvois system early will help you stay ahead of regulatory requirements while saving costs and optimising workflow management.

For businesses looking for expert guidance on e-invoicing implementation, system integration, and compliance, our trusted accounting firm in Klang and Selangor is here to help.

Contact us today to ensure a seamless transition to e-invoicing and stay ahead in Malaysia’s digital economy with NKH Chartered Accountants.

Kim Heng is an accounting and taxation professional whose sterling reputation has drawn countless clients to the NKH Group. When the GST was first introduced, he was commissioned to give 100+ talks on GST implementation as well as over 20++ talks on E- Invoice implementation by multiple businesses and industry associations, showing the depth of their confidence in his expertise. In the following years, Kim Heng would go on to share his knowledge on (among others) branding, tax planning, and fundraising at 20+ seminars organised by business associates that were widely attended by the public. He has over 20 years of experience consulting and advisory on taxation, corporate structure planning, business valuer, company secretarial administration, constitution advisory, and etc.